|

|

|

PENSION PLANS |

|

| Defined Benefits Plan: Employee receives a guaranteed amount based on salary and years of service - for as long as they live. Employers bear the investment decisions and risk. |

|

| Defined Contribution plan" : Employee receives lump sum payment based on both employee and employer contributions. While allowing benefit of portability and tax deduction - employees bear responsibility of investment decisions and risk of running out of money. |

|

COMPOUND INTEREST |

|

| When you earn interest on savings, that interest when added back to your savings, further earns interest on itself - increasing both your total savings and earnings. E.g. 10% interest on $100,000 would earn $ 10,000. If added back to original, you now earn 10% on $ 110,000 or $11,000. Next year 10% on $ 121,000 or $ 12,100 and soon. Over 5 years total interest earnings would be over $ 61,000 (vs. $10,000 * 5 = $ 50,000 via simple interest). Compound interest is often called the eighth wonder of the world, because it seems to possess magical powers |

|

- "Would you rather have $10,000 per day for 30 days or a penny that doubled in value every day for 30 days?" With doubling a penny, at the end of 30 days, you would have about $5 million versus the $300,000 if you choose $10,000 per day.

|

|

More Time you have more your money multiplies: |

|

- Say "A" - saves $2,000 per year between the ages of 24 and 30, that he earned a 12% after tax return until he retired at age 65. "B", on the other hand, also put in $2,000 per year, earned the same return, but waited until she was 30 to start and continued to invest $2,000 per year until she retired at age 65. In the end, both would end up with about $1 million. However, "A" had to invest only $12,000 (i.e., $2,000 for six years), while "B" had to invest $72,000 ($2,000 for 36 years) or six times the amount that "A" invested, just for waiting only six years to start investing

|

|

And higher the rate you earn , more your money multiplies: |

|

- Similar to "A" above - "X" and "Y" also began saving $2,000 a year for six years, but earned a lower 8% and 4% (vs. 12% for "A"). At age 65, "A" would have approx. $1,000,000, "X" $250,000, and "Y" only $55,000. Even though "A" earned only 8 percentage points more per year on his investments, over 40 years he would end up with about 20 times more money than "Y".

|

|

| Clearly - small changes in "rate of return" can make very large difference - over longer periods of time. |

|

|

|

|

Compound rate

of return |

|

$ 10,000 Investment |

|

|

|

|

|

|

|

5 Yrs |

|

10 Yrs |

|

20 Yrs |

|

|

|

|

|

4% |

|

12,200 |

|

14,800 |

|

21,900 |

|

|

|

|

|

6% |

|

13,400 |

|

17,900 |

|

26,500 |

|

|

|

|

|

8% |

|

14,700 |

|

21,600 |

|

46,600 |

|

|

|

|

|

10% |

|

16,100 |

|

25,900 |

|

67,300 |

|

|

|

|

|

12% |

|

17,600 |

|

31,100 |

|

96,500 |

|

|

|

|

|

14% |

|

19,300 |

|

37,100 |

|

137,400 |

|

|

|

|

|

16% |

|

21,000 |

|

44,100 |

|

194,600 |

|

|

|

|

|

18% |

|

22,900 |

|

52,300 |

|

273,900 |

|

|

|

|

|

20% |

|

24,900 |

|

61,900 |

|

383,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RULE OF 72 |

|

| It's an easy way to calculate how long it's going to take for your money to double. Take the number 72 and divide it by the interest rate you hope to earn. That number gives you the approximate number of years it will take for your investment to double |

|

- For example, if you wanted to know how many years it would take for an investment earning 12% to double, simply divide 72 by 12, and the answer would be approximately six years.

- The reverse is also true. If you wanted to know what interest rate you would have to earn to double your money in five years, then divide 72 by five, and the answer is about 15%.

|

|

Time to Double Your Money @ different Interest Rates |

|

| ( At 6% your money doubles in 12 years, and doubles again in 12 years i.e. increases four fold in 24 years ). |

|

|

|

|

Years |

|

Interest Rate |

|

|

|

|

|

|

|

3% |

|

6% |

|

12% |

|

|

|

|

|

0 |

|

10,000 |

|

10,000 |

|

10,000 |

|

|

|

|

|

6 |

|

|

|

|

|

20,000 |

|

|

|

|

|

12 |

|

|

|

20,000 |

|

40,000 |

|

|

|

|

|

18 |

|

|

|

|

|

80,000 |

|

|

|

|

|

24 |

|

20,000 |

|

40,000 |

|

160,000 |

|

|

|

|

|

30 |

|

|

|

|

|

320,000 |

|

|

|

|

|

36 |

|

|

|

80,000 |

|

640,000 |

|

|

|

|

|

42 |

|

|

|

|

|

1,280,000 |

|

|

|

|

|

48 |

|

40,000 |

|

160,000 |

|

2,560,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) Inflation has the "opposite" impact. At 6% - it cuts purchasing power of your money in half in 12 years - and half again in next 12 years to a quarter!. |

|

RETIREMENT SAVINGS |

|

| Most experts agree that one you will need approx. 80% of your pre retirement income in retirement. While expenses maybe lower on taxes, mortgage and children - medical expenses (and travel) are expected to be higher. With investment earnings replacing salary income - experts advice on withdrawing no more than 4% - 5% of savings each year. |

|

- To minimize year-on-year volatility - a prudent strategy is to limit withdrawls 4% of a 3 year moving average of your portfolio value. If you need 5%, to get more stability, put a rolling 5 year expenditure into more stable bond funds and rest in equities. Each year convert one more years of spending from equities to bonds.

|

|

| This would require approx. 16x - 18x of annual salary in savings. E.g. a $ 100k pre retirement salary would require $ 80k post retirement. At max 5% withdrawal - one would require total savings of $ 1.6 million or 16x (20x at 4% withdrawal) |

|

|

|

|

|

|

|

|

Income - pre retirement |

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

Income - in retirement |

|

80% |

|

80,000 |

|

|

|

|

|

|

|

|

|

% withdrawl |

|

4% |

|

|

|

|

|

5% |

|

|

|

|

|

Portfolio Reqd |

|

20 |

|

2,000,000 |

|

16 |

|

1,600,000 |

|

|

|

|

|

|

|

|

| So how does one save 16x of your annual salary. Saving 10% per year will require 160 years (at 15% 106 years)!. The answer is compound interest and time. As interest compounds - over time earnings from interest will be higher than savings - with larger impact as savings accumulate. Taking an income of $ 100k, annual savings of 15% and investment returns of 7.5%. In the 1st year - savings are $ 15k. However, once total savings have accumulated to $ 200k savings - ınterest earnings are $ 15k - same as annual savings. At $ 500k saving- interest earnings are $37.5k - or 2.5x savings. Over a life time of investing, your nest will comprise - 25% of savings and 75% from cumulative interest. |

|

|

Starting with a salary of (say) $30k, with annual increase of 3%, annual savings of 15% and return on investments of 7.5% - will ensure a total savings of $ 1.6 mm at 65 (or 16x final salary of $ 100k). Of this savings would account for 25% and earnings on investments 75% |

|

|

|

|

|

|

|

|

|

|

Income |

|

30,000 |

|

Final Income: |

|

100,000 |

|

|

|

|

|

|

|

Annual ıncrease |

|

3.1% |

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

12.5% - 17.5% |

|

Savings |

|

387,121.6 |

|

25% |

|

|

|

|

|

Investment Returns |

|

7.5% |

|

Interest |

|

1,69,531 |

|

75% |

|

|

|

|

|

|

|

|

|

|

|

1,556,652.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age |

|

Income |

|

Savings % |

|

Annual Savings |

|

Portfolio Earnings |

|

Total Portfolio |

|

Savings / Income Ratio |

|

|

|

|

|

25 |

|

30,000 |

|

12.5% |

|

3,750 |

|

0 |

|

3750 |

|

|

|

|

|

|

|

26 |

|

30,917 |

|

12.5% |

|

3,865 |

|

280 |

|

7,845 |

|

|

|

|

|

|

|

27 |

|

31,861 |

|

12.5% |

|

3,983 |

|

589 |

|

12,466 |

|

|

|

|

|

|

|

28 |

|

32,835 |

|

12.5% |

|

4,104 |

|

930 |

|

17,500 |

|

|

|

|

|

|

|

29 |

|

33,838 |

|

12.5% |

|

4,230 |

|

1,305 |

|

23,035 |

|

|

|

|

|

|

|

30 |

|

34,872 |

|

12.5% |

|

4,359 |

|

1,718 |

|

29,111 |

|

1 |

|

|

|

|

|

35 |

|

40,536 |

|

12.5% |

|

5,067 |

|

4,458 |

|

69,305 |

|

2 |

|

|

|

|

|

40 |

|

47,120 |

|

15.0% |

|

7,068 |

|

9,072 |

|

137,790 |

|

3 |

|

|

|

|

|

45 |

|

54,772 |

|

15.0% |

|

8,216 |

|

16,236 |

|

242,168 |

|

4 |

|

|

|

|

|

50 |

|

63,668 |

|

17.5% |

|

11,142 |

|

27,518 |

|

407,655 |

|

6 |

|

|

|

|

|

55 |

|

74,008 |

|

17.5% |

|

12,951 |

|

44,532 |

|

654,619 |

|

9 |

|

|

|

|

|

60 |

|

86,028 |

|

17.5% |

|

15,055 |

|

69,739 |

|

1,019,925 |

|

12 |

|

|

|

|

|

65 |

|

100,000 |

|

17.5% |

|

17,500 |

|

106,818 |

|

1,556,652 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Of course individual savings rate would vary (and by age), as would yearly returns on investments. But realistic savings goals and long term market average returns are sufficient to achieve your goals. But you need time and while stocks may be a riskier investment in the short run, they are critical to long-term goals. |

|

MORTGAGE |

|

|

| We need a place to live. Once mortgage is paid off - it also frees up cash flows for other expenses / savings. Beyond that beyond a home provides a sense of security and financial stability - that money alone cannot. Most financial experts encourage buying a home and paying off in a prudent manner. Yet, Mortgage should not be confused with an investment. It does not provide you an income. |

|

- As Robert Kiyosaki says - Assets and liabilities are not based on balance sheet, but on profit and loss statement. Asset puts money in your pocket, while Liability takes money from your pocket. A Mortgage is really an Liability!.

|

|

| More importantly - monthly payments takes money away from your savings. You need to buy a house appropriate for your income and life style and pay back in a prudent manner. While banks may allow a monthly repayment debt of up to 35% - you may want to restrict to a lower % - if you still want to save 10% - 15% of income (post taxes, social security, and living expenses). Given importance of "time" and compound interest - It is important that you start saving early. Else you may end up being "asset rich, but cash poor". |

|

- Monthly repayments will vary based on tenor and interest rates. But a 10% down payment, 25 year tenor and more realistic longer term interest rates - may restrict mortgage to 3 - 4 years of income.

|

|

| |

|

|

|

|

|

|

|

Salary |

|

100% |

|

|

|

|

|

Tax/ Social Security |

|

-20% |

|

|

|

|

|

Savings |

|

-15% |

|

|

|

|

|

Mortgage |

|

-25% |

|

|

|

|

|

Balance |

|

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenor |

|

25yrs |

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Debt Burden |

|

25% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

|

2.5% |

|

3.5% |

|

4.5% |

|

5.0% |

|

6.0% |

|

|

|

|

|

Max Loan multiple

(months) |

|

56 |

|

50 |

|

45 |

|

43 |

|

39 |

|

|

|

|

|

|

|

|

|

|

- Given monthly repayments remain constant - as loan is paid off over time - initially most of the monthly repayments go towards interest (with principal repayment increasing over time). Reducing the tenor of the loan, while increasing monthly payments, has a significantly larger savings over life of loan.

|

|

|

At 5.0% interest, reducing tenor from 25 years to 20 years can increase monthly payment by 12% - but lower total interest payments 22%. |

|

|

|

Similar benefits can accrue by making bi weekly vs monthly payments, or making an extra capital repayment, annually. Overall, paying back early in a prudent manner - can mean significant savings. |

|

|

|

|

|

Interest Rate |

|

3.5% |

|

5.0% |

|

|

|

|

|

Loan Tenor |

|

15 Yrs |

|

20Yrs |

|

25Yrs |

|

15Yrs |

|

20Yrs |

|

25Yrs |

|

|

|

|

|

Monthly Payment |

|

712 |

|

578 |

|

500 |

|

788 |

|

658 |

|

584 |

|

|

|

|

|

Total Repayment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Principal |

|

100,000 |

|

100,000 |

|

100,000 |

|

100,000 |

|

100,000 |

|

100,000 |

|

|

|

|

|

- Interest |

|

28,850 |

|

39,370 |

|

50,374 |

|

42,606 |

|

58,665 |

|

75,668 |

|

|

|

|

|

|

|

128,850 |

|

139,370 |

|

150,374 |

|

142,606 |

|

158,665 |

|

175,668 |

|

|

|

|

|

|

|

1.3 |

|

1.4 |

|

1.5 |

|

1.4 |

|

1.6 |

|

1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLAR COST AVERAGING |

|

| An investment strategy of using a fixed $ amount to purchase a particular investment on a regular basis. When prices rise you buy a lesser # of shares/ units and when prices fall you buy a larger # of shares/ units. As you buy more # of shares when prices are lower (and vice versa) -technique allows you to lower the average cost of investments, over time. Further, it lowers the risk of investing a large amount in a single investment at wrong time / price |

|

- This would work in different scenarios - of rising, falling and volatile markets (of course this does not protect against losses in a falling market, or maximize gains in a rising market)

|

|

|

|

|

|

|

Volatile Market |

|

Rising Market |

|

Falling Market |

|

|

|

|

|

|

|

Investment |

|

Price |

|

Shares purchased |

|

Price |

|

Shares purchased |

|

Price |

|

Shares purchased |

|

|

|

|

|

Period 1 |

|

1,000 |

|

100 |

|

10 |

|

100 |

|

10 |

|

100 |

|

10 |

|

|

|

|

|

Period 2 |

|

1,000 |

|

75 |

|

13 |

|

110 |

|

9 |

|

90 |

|

11 |

|

|

|

|

|

Period 3 |

|

1,000 |

|

50 |

|

20 |

|

125 |

|

8 |

|

75 |

|

13 |

|

|

|

|

|

Period 4 |

|

1,000 |

|

150 |

|

7 |

|

140 |

|

7 |

|

60 |

|

17 |

|

|

|

|

|

Period 5 |

|

1,000 |

|

100 |

|

10 |

|

150 |

|

7 |

|

50 |

|

20 |

|

|

|

|

|

|

|

5,000 |

|

|

|

60 |

|

|

|

41 |

|

|

|

71 |

|

|

|

|

|

Avg. Market Price |

|

95 |

|

|

|

125 |

|

|

|

75 |

|

|

|

|

|

|

|

Avg. Purchase Price |

|

83 |

|

|

|

122 |

|

|

|

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET ALLOCATION and REBALANCING |

|

|

| Different asset classes (equities, fixed income and cash) have different risks and returns. More over they have low correlation to one another (i.e. performance good or bad at different times). As not to put all your eggs in one basket, it is prudent to diversify your investments across these. |

|

- Large losses are very difficult to recover from, and must be avoided. While a 10% loss, will require a 11% gain to recover. However a 50% loss, requires a 100% gain to recover (and a 75% loss - a 300% gain!).

|

|

|

|

|

|

|

|

|

Loss % |

|

10% |

|

20% |

|

25% |

|

50% |

|

75% |

|

90% |

|

|

|

|

|

% Gain reqd to recover |

|

11% |

|

25% |

|

33% |

|

100% |

|

300% |

|

900% |

|

|

|

|

|

|

|

|

| Studies have shown that asset allocation is the single most important factor in determining returns from investing. Academic research shows - "that more than 90% of variability of investor returns come from asset allocations, with stock selection and market timings having only secondary roles". |

|

| There is obviously no one asset allocation formula or strategy that will be appropriate for everyone. However as a general rule - the younger you are the higher % you should have in equities (higher return that you will need to build your financial nest, as well as allows for more time to recover from higher risks) - and the older you are the higher % you should have in fixed income/ bonds (while lower returns, you should be closer to have built up your financial nest, and more importantly may not have sufficient time for portfolio to recover from higher risks associated with equities). |

|

| The mix should be determined by both - (i.) objective - growth, income, safety, and (ii.) timing, when money will be required. |

|

- A common convention used to determine the equity % of your portfolio - is to subtract your age from 100 (or bond holdings equal to your age). Another is based on time horizons: 60% equity: 40% bonds - for a 5 year horizon; 80%: 20% for a 10 year horizon and 90%: 10% for a 15 year horizon.

- However these may not always be the most appropriate. Even in retirement - your monies may need to stay invested for a long time. Assuming a 5% return on bonds and 10% on equity - shifting from a 60% equity/ 40% bond mix to a 80%:20% - the incremental rate of returns would be 1.0% annually. The can be a huge difference over a long period.

|

|

REBALANCING |

|

| As market volatility will lead to shifts in asset allocations over time - it is recommended to review and rebalance your portfolio on a periodic basis (annually). Sell the asset class that has risen and now forms a larger portion of your portfolio mix, and buy the asset class that has fallen. |

|

- Infact, of all the market techniques, this may actually get you closest to goal of "buy low, sell high".

|

|

STOCK MARKET & INVESTOR RETURNS |

|

| Stock Market Returns are a combination of investment returns and speculative returns. However, when returns on stocks depart materially from the long term norm, it is rarely because of the economics of investing (earnings growth and dividend yield). Rather, the reason that annual stock returns are so volatile is largely because of the emotions of investing. |

|

- Investment returns: Aggregate of dividends and earnings growth. An analysis by John Bogle, looking at trends over last 100 years – shows both steady and long term norms of 3% - 7% each (average of 4,5% - 5.0%). Total market returns steady within 8% - 13% (average 9.5%).

- Speculative returns (based on changes in PE), however are very volatile (using Rule of 72 - a doubling of PE from 10x to 20x over 10 years would require a 7.2% annual return). However, by an large a reversion to the mean (with each decade of negative returns, followed by a decade of correlated positive returns). Over the century, PE increased from 15x to 18x - adding average return of 0.1%.

- Adding the two - while large volatility on changes to PE ratio - the average annual return on stocks of 9.6%, almost all entirely on account of dividend and earnings growth. And while changes in investor emotions, impossible to predict - long term return on stocks can be forecast remark accurately, based on earnings and dividend growth.

- Infact, most of the historical excesses - (i.) Tulip Mania (Holland, early 1600s); (ii) South Sea Bubble (Britain 1720s ); (iii.) America 1920s,(iv.) New issue craze (1960 s), (v.) mergers mania (late 60s), (vi.) Nifty Fifty (1970s), (vii.) New issues (1980s), (viii.) Japan (1990s), (ix.) Dot-com (Late 90s), and (x.) Credit bubble (2000 s) - all saw large increase in PE ratios. But, more importantly - they (ultimately) corrected.

|

|

| Moral of the story: Invest in the real economy and ignore the market. |

|

|

|

|

Decade |

|

1900s |

|

1910s |

|

1920s |

|

1930s |

|

1940s |

|

1950s |

|

1960s |

|

1970s |

|

1980s |

|

1990s |

|

2000s |

|

Average |

|

|

|

|

|

Dividend |

|

3.5% |

|

4.3% |

|

5.9% |

|

4.5% |

|

5.0% |

|

6.9% |

|

3.1% |

|

3.5% |

|

5.2% |

|

3.2% |

|

1.1% |

|

4.5% |

|

|

|

|

|

Earnings Growth |

|

4.7% |

|

2.0% |

|

5.6% |

|

-5.0% |

|

9.9% |

|

3.9% |

|

5.5% |

|

9.9% |

|

4.4% |

|

7.4% |

|

5.7% |

|

5.0% |

|

|

|

|

|

|

|

8.2% |

|

6.3% |

|

11.5% |

|

-0.5% |

|

14.9% |

|

10.8% |

|

8.6% |

|

13.4% |

|

9.6% |

|

10.6% |

|

6.8% |

|

9.5% |

|

|

|

|

|

Change in PE |

|

0.8% |

|

-3.4% |

|

3.3% |

|

0.3% |

|

-6.3% |

|

9.3% |

|

-1.0% |

|

-7.5% |

|

7.7% |

|

7.2% |

|

-8.0% |

|

0.1% |

|

|

|

|

|

(PE) |

|

(15x) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(32x) |

|

(18x) |

|

|

|

|

|

|

|

Market Returrns |

|

9.0% |

|

9.6% |

|

14.8% |

|

-0.2% |

|

8.6% |

|

20.1% |

|

7.6% |

|

5.9% |

|

17.3% |

|

17.8% |

|

-1.2% |

|

9.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Source: John C. Bogle, "The Little Book of Common Sense Investing" |

|

| Going forward we could expect lower returns. Total investment maybe expected to be 8% (2% dividend and 6% earnings growth). However, last 25 years saw PE doubling from 9x to 18x - adding nearly 2.7% growth p.a. Clearly PE ratios cannot be expected to double again. Infact they come down a bit. Assuming a 1% lower return p.a. - leaves a total market return on 7.0% p.a. |

|

| A similar work by Burton Malkiel (A Random Walk Down Wall Street) lists the key predictors to stock market returns as (i.) initial dividend yield, (ii.) earnings growth, and (iii.) Changes in PE. Projections for decade starting 2010 are again lower - on lower dividend yield and PE ratios. |

|

|

|

|

|

|

Last 100 years |

|

Last 25 years |

|

Next 10 years |

|

|

|

|

|

Dividend |

|

4.5% |

|

3.4% |

|

2.0% |

|

|

|

|

|

Earnings Growth |

|

5.0% |

|

6.4% |

|

6.0% |

|

|

|

|

|

P/E change |

|

0.1% |

|

2.7% |

|

-1.0% |

|

|

|

|

|

Total return |

|

9.6% |

|

12.5% |

|

7.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: John C. Bogle, "The Little Book of Common Sense Investing" |

|

|

|

|

|

|

|

(Jan 1946 - Dec 1968 |

|

(Jan 1969 - Dec 1981) |

|

(Jan 1982 - Dec 2000) |

|

2010 - 2020 |

|

|

|

|

Initial Divd. Yield |

|

5.0% |

|

3.1% |

|

5.8% |

|

2.0% |

|

|

|

|

Earnings Growth |

|

6.6% |

|

8.0% |

|

6.8% |

|

6.0% |

|

|

|

|

Changes in PE |

|

2.4% |

|

-5.5% |

|

5.7% |

|

-1.0% |

|

|

|

|

Avg Annual Return |

|

14.0% |

|

5.6% |

|

18.3% |

|

7.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Burton Malkiek, " A Randon Walk Down Wall Street" |

|

|

|

|

INVESTOR RETURNS |

|

| As seen, markets are (very) volatile in the short term, they can be (very) predictable over the longer term. However, it is critical to stay invested - thru the cycle - else you cannot achieve the expected long-term returns. Further, given the long-term trends and predictability - the goal is not to increase returns, but to manage risks to allow market returns. |

|

- A disproportionate amount of the market growth, has tended to come over very short periods - and in attempting to "time" the market, one risks loosing this growth (mostly in the very early stages of recovery) . One needs to be there - when lightning strikes (!)

|

|

|

Research by Cambridge Associates (covering period 1990-2008) shows that the 11.1% compound growth seen by S & P 500 over this period reduces to half (5.5%) - if just the best "30" trading days are excluded. Same research shows that over a longer 75 year period (1928 - 2000) - all the returns were achieved in the best 60 months. |

|

|

|

|

|

|

|

|

|

|

|

S & P 500 |

|

Less 10 best days |

|

Less 20 best days |

|

Less 30 best days |

|

|

|

|

|

Compound Return

(1990 - 2008) |

|

11.1% |

|

8.6% |

|

6.9% |

|

5.5% |

|

|

|

|

|

|

|

|

|

(*) Source: Cambridge Associates |

|

|

- While over the long term stocks have provided higher returns, in the short term they can be much more volatile. Averages - over artificial points of time - can be deceiving and inappropriate for what is a continuous process. A gain of 50%, followed by a loss of 33% - does not get leave you with a 17% gain. Its 0% - do the math.

|

|

|

Reserach by Alliance Bernstein (covering period 1926 – 2007) – shows best and worst 1 year stock returns as + 53% and (-) 43%. An average 1 year return would be almost meaningless. However, looking at 10 year periods - only "1" 10 year period experienced a loss - and the range of gains was between 5% to 15%. Looking at longer 20 year periods - there were no losses, only gains and centered around the average rate of return. |

|

|

|

|

|

S&P (1926 - 2007) |

|

Rolling Returns |

|

|

|

|

|

|

|

1 Yr |

|

5 Yr |

|

10 Yr |

|

15 Yr |

|

20 Yr |

|

30 Yr |

|

|

|

|

|

Best Year |

|

53% |

|

29% |

|

20% |

|

18% |

|

19% |

|

14% |

|

|

|

|

|

Worst Year |

|

-43% |

|

-12% |

|

-1% |

|

1% |

|

3% |

|

8% |

|

|

|

|

|

Average |

|

12% |

|

10% |

|

11% |

|

11% |

|

11% |

|

11% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) source: Alliance Bernstein |

|

|

INDEX FUNDS Vs. ACTIVE MANAGED FUNDS (Vs. STOCKS): |

|

|

| All investors as a group must necessarily earn precisely the market return, but only before costs of investing are deducted. After deducting costs (fees, commissions, sales load, expenses etc. - return investors will get will fall short of market returns by precisely the aggregate of those costs. |

|

- Market Return (-) Costs = Investor Returns

- Only way to beat the market is to depart from the market portfolio. And this is what active managers do. But (i.) it adds costs, and (ii) rarely works - on a consistent basis over time.

|

|

| Index funds allow two advantages over actively managed funds - (i) Broad diversification, and (ii.) Lower costs – as do not require expensive fund managers. |

|

- Broad based ETFs (Exchange Traded Funds) are an alternative to Low Cost Index Funds. However, these must again be broad based, low cost and held for long term (unfortunately a recent trend appears to be to trade ETFs short term - similar to stocks).

- Actively managed funds, only if run by managers who own them and invest for the long run (without benchmak hugging)

|

|

| (1.) Costs: To cover a competitive 3.25% costs for funds (2% trading costs + 1.25% fees and commission) - over the historical market average return of 10%, would mean outperforming the market by nearly a third!. |

|

- "Over the long term the magic of compounding, is overwhelmed by the tyranny of compounding cost". Analysis by John Bogle (covering 1980 thru 2005) - shows return on S & P 500 averaged 12.5% p.a. The return on average mutual fund was 10%. A $ 10,000 investment in Index Fund grew by # 170,000, compared with 100,000 in average mutual fund. 40% less. Assuming a (long term) 8% return on stocks and mutual fund costs of 2.5%. A $10,000 investment at 8% over 50 years grows to $ 469,000. However at 5.5% - it is only $ 145,000. A shortfall of nearly 70%. Worse, as the original investor - your $ 10,000 bore 100% of the risks, but the fund with 0% of investment (and risk) - got 70% of the returns.

- Further the last decade has seen high returns. A 2.5% costs would account for 16% of "15%" returns but a materially higher 25% if returns lower at 10% returns (and 33% if returns only 7.5%).

|

|

| (2) Returns: historical data shows that over longer periods of -- eight out of ten mutual funds did not beat the market by enough to cover the cost of their higher expenses. While, it's not uncommon for a fund to have a "hot" year, it's very uncommon for a fund to consistently beat the market over the longer term - and impossible to identify these funds in advance!. |

|

- Historically , we have seen numerous investment strategies and fads - including: (i.) Hemline indicator, (ii) Super bowl indicator, (iii.) Dogs of the Dow, (iv.) January Effect, (v.) Trend is your friend, (vi.) Dividend jackpot. Further, new investment technologies, include - (a.) Modern Portfolio Theory (MPT), (b.) Capital Asset Pricing Model (CAPM), (c.) Behavioral Finance etc.. And short term, patterns can sometimes make money. But, if market patterns exist and miss pricing frequently exist then professional investment managers sought to be able to beat a simple index fund. They don't.

- Over 1 year - 30% of active funds maybe expected to out perform the index, over 5 years - 15%, over 10 years 10% and over 25 years less than 5%.

|

|

| |

|

|

|

Funds outperformed by S & P 500 (Data thru Dec 2008) |

|

% |

|

|

|

|

|

1 yr |

|

61% |

|

|

|

|

|

3 years |

|

64% |

|

|

|

|

|

5 years |

|

62% |

|

|

|

|

|

10 years |

|

64% |

|

|

|

|

|

20 years |

|

68% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"Long term fund

performance

(vs. Market)" |

|

% Funds |

|

|

|

|

|

(-) 2%or worse |

|

16% |

|

|

|

|

|

(-) 2%- 0% |

|

57% |

|

|

|

|

|

0%-2+ |

|

26% |

|

|

|

|

|

2%+ |

|

2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) Source: Lipper & Vanguard Group |

|

|

- Worse, real investor returns are lower than returns reported by the industry. Fund performance are normally reported on a "time-weighted" basis. However, to understand actual investor returns, one needs to look at "dollar-weighted" returns i.e. factoring in timing (and prices) of inflows and outflows - that show much lower returns (investors tend to buy hot funds after most of price appreciation may have occured i.e buy high and sell low!). While this would equaly apply to index funds - the impact is lower given that fund/ sector and stock risks are eliminated

- Studies show 95% of all inflows to mutual funds, flow to highly rated funds. These ratings are based on historical 3,5 and 10 year periods. But in a majority of cases - the future performance of these funds lags the market (some times, substantially). Analysing winning funds over a 5 year period , John Bogle found that - while the funds achieved a gain of 13%, investors in the funds incurred a loss of 57%

- The best time to sell a new fund to investors - when its hot - is often the worst time to buy it . Betting on hot sectors (emotions) and paying heavy costs (expenses) - can be a double whammy.

|

|

|

|

|

|

|

|

Short Term Winners |

|

Time weighted |

|

Dollar weighted |

|

|

|

|

|

|

|

1996 - 1999 |

|

1999 - 2002 |

|

1996 - 2002 |

|

|

|

|

|

|

|

Average |

|

279% |

|

-70% |

|

13% |

|

-57% |

|

|

|

|

|

|

|

|

| Source: John C. Bogle, "The Little Book of Common Sense Investing" |

|

- Finally, there is the "survivor" bias. The industry long term performance only reflects - the mutual funds that survive. And large Nos do not. Going back to 1970 - there were # 355 equity funds in the US. Fast forward to today and only # 132 still exist i.e over 60% have gone. And only # 24 (i.e. less than 7%) outpaced the S & P 500 by > 1%. Further, even these had most of the superior performance, many years ago - when they were a smaller size.

|

|

| In summary - historical performance nor recent fads work, over the long term. The only constant are costs. And the lower these are - higher are the investor returns. Broad based, low cost index funds allow the advantages of - (i.) diversification, (ii.) minimize costs and (iii.) remove emotions from discipline of investing. They eliminate the risk of (i.) individual stocks, (ii.) market sector, and (iii.) manager's selection. Only (iv.) stock market risk remains. Cap-weighted index also allow automatic "rebalancing" with no action is required to adjust to changing prices. |

|

| Of course, investing in a stock index fund guarantees that you'll never outperform the overall market -but, (i) few actually do, and (ii) goal, not to beat market - but get predictable returns over the longer term - to meet your financial goals. |

|

An Alternate View  |

|

| Efficient market theory and the multitude of (highly) paid analyst would appear to make individual stock picking a "losers game". However, there is an alternate view, that provides small investors - willing to do their homework - an advantage. |

|

Mutual Funds not serving best interests of investors |

|

- As mutual fund fees are paid as percent of asset under management (AUM ), the overiding drive amongst fund managers is for asset size. However, data consistently shows that large size are sub optimal for investor returns.

- Emphasis on market share leads to increased marketing and push to bring out new niche funds. Both, negatively impact consumers via higher expenses and increased volatility.

|

|

Bias in analyst industry |

|

- Analyst are not paid directly by clients, but research provided to clients for new business. As universe of stocks not owned is always larger than stocks owned - it is easier to generate commissions from new "buy" recommendations.

- Most analyst only cover one industry. A buy recommendation is thus in context of others in the same industry versus across industries

|

|

| As an investor, you do not need to restrict yourself to any one industry, but choose those offering highest potential returns, across Industries. |

|

Diversification only addresses a part of total risk- it does not address market risk (risk of total market going up or down). |

|

- Beyond # 6 or 8 stocks (in different industries), overall market risk is not eliminated by merely adding more stocks

|

|

|

|

| In a practical sense, fund managers add stocks more driven by fund size and legal considerations, than merely stock considerations or diversification. |

|

- # 9,000 stocks listed on NYSE. Of this # 1,500 stocks have a market cap > $ 1 billion (and # 800 with a market cap of > $2.5 billion). If you do not want to hold > 10% of any one companies total stock - a fund of $ 10 billion will need to hold # 50 - 100 stocks.

|

|

| Individual investors are not constrained similarly and can limit to few optimal picks. |

|

The slightly higher annual volatility, in a smaller portfolio, may provide higher returns over the longer term. |

|

| Better to diversify - across asset classes (cash, bonds, stocks, real estate and insurance) versus diverification in your stock portfolio only. |

|

|

|

# Stocks owned |

|

% Non Market risk eliminared |

|

|

|

|

2 |

|

46% |

|

|

|

|

4 |

|

72% |

|

|

|

|

8 |

|

81% |

|

|

|

|

16 |

|

93% |

|

|

|

|

32 |

|

96% |

|

|

|

|

500 |

|

99% |

|

|

|

|

|

|

|

|

|

|

|

|

# Stocks owned |

|

1 year return

(Long term return 10%) |

|

|

|

|

500 |

|

(-) 8% to +28% |

|

|

|

|

8 |

|

(-) 10% to +30% |

|

|

|

|

5 |

|

(-) 11% to +31% |

|

|

|

|

|

|

|

|

|

|

|

|

| Source: Joel Greenblatt, Stock Market Genius. |

|

|

Investing in Stocks  |

|

| When you buy a companies stock - in effect you are buying its cash flows based on future profits. The key to investing is not how much a company/ industry will impact society or how much it will grow - but its ability to make sustainable profits. |

|

- Investment 101: Avoid the mistake of confusing a great company with a great investment - the two can be very different.

|

|

|

|

|

Investment Philosophy: |

|

Investment Strategy |

|

|

|

|

|

- Rule #1: Never lose money.

- Rule #2: Never forget Rule #1.

- Risk is not same as volatility.

- Understand the difference between price and value.

- In the short run, the market is a voting machine, but in the long run, it is a weighing machine.

- Make sure that you have a margin of safety

|

|

|

- Focus on companies with strong Economic Moat.

- Buy at a discount to Fair Value

- Know when to sell

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Philosophy: |

|

| 1. Rule #1: Never lose money. Rule #2: Never forget Rule #1. |

|

| Look down, not up. If you dont loose money, most of the other alternatives look good. |

|

- Large losses are very difficult to recover from, and must be avoided. While a 10% loss, will require a 11% gain to recover, a 50% loss, requires a 100% gain to recover (and a 75% loss - a 300% gain!).

|

|

| 2. Risk is not same as volatility: Higher risk does not mean higher reward. |

|

- The standard beta definition (price volatility of a particular stock relative to the market as a whole) - measures risk in a erroneous way - equating volatility with risk. A measure of relative short term volatility vs. longer term potential for loss.

- As investors, one is not concerned with volatility, per se, but the possibility of losing money (or not achieving a satisfactory return).. A stock that has fallen from $ 30 to $ 10 is considered more risky than one that has fallen from $ 12 to $ 10, even though the latter is available at a greater discount (and the expectation of reward maybe greater!).

- Sometimes risk and reward are correlated in a positive fashion e.g. - a higher payout for undertaking a risky venture. The exact opposite is true with value investing The greater the potential for reward, the less risk there is.

|

|

| 3. Understand the difference between price and value. |

|

- "Price is what you pay. Value is what you get." The basic concept is that an asset has an underlying value or "intrinsic value" that is separate from its price. A business is valuable whether you intend to sell it or not because it generates cash flows.

|

|

| 4. In the short run, the market is a voting machine, but in the long run, it is a weighing machine |

|

- In the short run, prices can differ widely from value, but in the long run, price and value tend to converge. You don’t need to concern yourself with market psychology, price charts, or anything else not related to the intrinsic value of the company.

|

|

| 5. Make sure that you have a margin of safety |

|

- Stock Market Returns are a combination of (i.) investment returns (Earnings growth + Dividends), and (ii.) speculative returns (changes in P/E ratio).

- As impossible to know future P/E ratio - valuation is critical. Return is dependent on the Price you buy at. Buying at lower PE lowers risk by allowing for a "margin of error" as well as opportunity to benefit from growth.

|

|

Investment Strategy: |

|

| 1. Look at stocks as a business: In buying a stock, you are buying future cash flows. Focus on return on capital. As markets very competitive, and predicting future, very difficult, focus on businesses that posses a long term advantage. An economic moat. |

|

- Moats not based on (i.) Products, (ii) Market share, (iii.) Execution, or (iv.) Management. But, (i) Intangible Assets (brand, patents, regulatory licenses), (ii) High switching costs, (iii) Network economics, and (iv.) Cost advantages (location, process or scale). Do not fall in love with product, but where model allows long term pricing power or cost advantage.

- Key financials include (i.) Free Cash Flow, and (ii.) Return on Capital.

|

|

| 2. Determine the true value of a business and buy stocks in these companies when they go on sale. Valuation may not be a pre-requisite for successful investing, but it does help make more informed decisions |

|

| Dozens of valuation models but only two approaches: intrinsic and relative. Intrinsic valuation, based on expected cash flows and associated risk. Relative valuation based on market pricing of similar assets.While purists on both sides – no reason to choose one over the other, as can use both. Invest in stocks that are under valued on both intrinsic and relative basis. |

|

- Basic difference in intrinsic and relative valuations, is based on different views on market efficiency (or in-efficiency). Intrinsic valuation assumes, markets make short term mistakes, that can occur across sectors or entire market, but correct longer term. Relative valuation assumes, that while markets make mistakes on individual stocks, they are correct on average.

- To make money based on undervalued intrinsic value – market will have to corrects its valuation. And that may not happen soon. So a long term approach is a pre requisite to using intrinsic valuation.

|

|

| 3. Have a margin of safety. : |

|

- A margin of safety exists when the purchase price of an investment is lower than intrinsic value. Not only does this provide strong protection against downside risk, but also provides a good chance at earning high returns.

- Look at discount of 25% - 50%, depending on width and depth of economic moat.

- Use a markets fluctuations to your advantage. However, good companies are not always available at a discount. You must be, do your home-work, and have the courage to take a stance thats different from the crowd .

|

| 4. Make a profit by selling your business at above their intrinsic value. Hardest part of Investing is knowing when to sell. |

|

- Constantly monitor the companies you own, rather than the stocks you own.

- Sell not on stock price, but on values of company - (i.) initial assumptions wrong, (ii) company dynamics changed, (iii) better investment opportunities arise, or (ii) stock too large a percent of holding.

|

|

Number Crunching: |

|

Financial Analysis |

|

| Key financials include (i.) Free Cash Flow, and (ii.) Return on Capital. Review consistency of trends over 5 - 10 years. |

|

- Free Cash Flow equals cash flows less capital expenses, and represents monies available to shareholders, after investments required for growth.

- Profitability: What is important is not just absolute profits, but profits relative to capital required to earn it (it takes money to make money!). DuPont Analysis, provides a 3 step analysis to convert capital into earnings: - net margin , asset turnover and financial leverage.

|

|

|

|

Financial Metrics |

|

Benchmark |

|

Remarks |

|

Metrics |

|

|

|

|

|

Free cash flow |

|

> 5% sales |

|

|

|

Operating cash flow - Capital Expenditure |

|

|

|

|

|

|

|

|

|

Return on Assets

RoA = Net Margin x Asset Turnover |

|

Non financial Co

- RAO > 7% |

|

Ignores Debt, giving

RoC a leveraged component |

|

Net Margin

> 15% |

|

Net Income |

|

| Sales |

|

Asset

Turnover |

|

Sales

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

Return on Equity

RoE= RoA x Financial Leverage |

|

ROE > 15% |

|

Ignores Debt. Can increase ROE by taking more debt without becoming more profitable |

|

| Financial Leverage |

|

Assets

|

|

| Equity |

|

|

|

|

|

|

|

|

|

|

Return on Invested Capital |

|

RoIC > 10% |

|

Return on all

capital (debt + equity). |

|

| Operating Profit |

|

Profit after tax + Interest costs |

|

| Invested Capital |

|

Assets - Non Interest bearing liabilities - cash balances. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

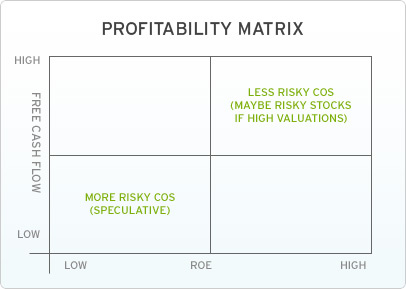

Profitability Matrix: |

|

| Look at companies with high free cash flow and high RoE (of course these may still be risky stocks, if valuations high, Buy, when available at a discount) |

|

|

|

| Source: Morningstar Inc. |

|

Valuations |

|

| Valuation always built on assumptions. More data will not always mean more precision. Infact a case maybe made for the Kiss principle - Keep It Simple Stupid! |

|

| Multiples: |

|

| Easy to use (and mis-use). Must ensure defined consistently as well as appropriate benchmark (median values better than average). |

|

- Common Price multiples include - (a.) Price-to-Sales (P/S), (b.) Price-to-Book (P/B), and (iii.) Price-to-Earnings (P/E) ratio. While PE most common, PS and PB also appropriate where earnings temporarily depressed, and for specific industries (banks). There however difficult to compare across industries. Also, important to consider, differences in growth rate and return on capital

|

|

|

|

Multiple |

|

Advantages |

|

Dis advantages |

|

Undervalued stock |

|

|

|

|

|

Price-to-Sales (P/S) |

|

Cyclical Cos, or where "E" temporarily depressed |

|

Biased by industry margin - so not comparable across industries |

|

Low P/S

High Net Profit margin |

|

|

|

|

|

Price-to-Book (P/B) |

|

Earnings difficult to value but Assets more tangible.

Usefull for Banks, as Assets "liquid" and easy to "value" |

|

Service/ Tech Cos Assets (people, process) not in book value Maybe inflated by "good-will"

Banks may hide bad loans or where valuation difficult |

|

Low P/B

High RoE |

|

|

|

|

|

Price - Earnings (P/E) |

|

Earnings good proxy for value generation and estimates readilly available |

|

Which "E"

Must consider in context of ROG, ROIC etc |

|

Low P/E

High RoG |

|

|

|

|

|

Yield |

|

Converse of PE |

|

Easy to compare to fixed income instruments (but fixed versus growth) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Intrinsic Value: |

|

| Calculated as Present value of future cash flows, on per share basis. |

|

- The Time Value of future cash flows is done based on discounting,with discount rate (9% - 14%), reflecting the magnitute of risk.

- Calculate cash flows for next 10 years, and a perpetuity value, separately – as long term based growth rates, will need very different assumptions

- Note: formulae for perpuity value has two contraints - growth rate has to be less than discount rate, as well as lower than overall GDP growth.

|

|

|

|

Steps |

|

Formulae: |

|

|

|

|

|

1 |

|

Forecast future cash flows (using

assumed growth rate on current cash flow) |

|

Discount

Rate |

|

Time Value + Risk Premium |

|

Discount rate

9 - 14% (depending on risk) |

|

|

|

|

|

2 |

|

Calculate Present Value, by using

Discount Rate |

|

Present

Value |

|

|

|

CF = cash flow

R = discount rate

Year = N |

|

|

|

|

|

3 |

|

Calculate perpetuity value and discount to Present value |

|

Perpetuity

Value |

|

|

|

g = long term growth rate |

|

|

|

|

|

4 |

|

Add to get Total Equity Value |

|

Total Equity

Value |

|

Present Value + Perpetuity Value |

|

|

|

|

|

|

|

5 |

|

Calculate per share value |

|

Per Share

Value |

|

| Total Equity Value |

|

| Outstanding Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Source: Morningstar Inc. |

|

Margin of Safety: |

|

- 25 % - 50%, depending on risk (economic moat).

|

|

An Alternate Methodology: |

|

| An alternate approach, calculates "intrinsic price" by using current earnings per share and growth rate to calculate future EPS. Multiplying by average compare/ industry PE ratio - provides a future price. Assuming a min. return on investment, this is then discounted to calculate current intrinsic price (At 15% return, rule of 72 would mean doubling in 5 years, so divide year 10 price by 4). |

|

|

|

|

Intrinsic Price |

|

|

|

10 year projection |

|

Remarks |

|

|

|

|

|

EPS |

|

2,50 |

|

6,48 |

|

EPS*(1+ROG)^10 |

|

|

|

|

|

EPS growth |

|

10,00% |

|

|

|

|

|

|

|

|

|

PE ratio |

|

12 |

|

|

|

|

|

|

|

|

|

Px in 10 yrs |

|

|

|

77,81 |

|

Future EPS * PE ratio.

|

|

|

|

|

|

Current Intrinsic Value |

|

(return - 15% p.a. ) |

|

19,45 |

|

Divide by 4 (Rule of 72 - @ 15% doubles in 5 years) |

|

|

|

|

|

Margin for Error |

|

50% |

|

50% |

|

Divide by 2 (50% margin) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Source: Phil Town, Rule # 1. |

|

|

Industry Overview: |

|

| Different companies operate in different industries, with very different dynamics that must be considered. Also important to understand the unique characteristics and drivers for each industry. |

|

|

|

|

Industry |

|

Overview |

|

Key Factors |

|

Investment Opportunities |

|

|

|

|

|

Business Services |

|

Wide scope - outsorcing, consulting, advertising, data processing, waste hauling, |

|

| Wide moat businesses, with high switching costs (Integrate with business processes) and low ongoing capital expenses |

| Brand and Economies of scale |

|

|

| Technology and Hard-asset based based, have wider moat

People based, and airlines with most narrow moat. |

| Airlines - large capital requirements with a commodity service difficult to differentiate |

|

|

|

|

|

|

|

|

|

|

Consumer Goods |

|

Retail, Restaurants, |

|

| No economic moat. Low switching costs |

| Low return business. Store management (cash conversion cycle ) and economies of scale critical |

|

|

Discretionary. Outperform in economic growth (underperform during weak economy) |

|

|

|

|

|

|

|

|

|

Consumer Services |

|

Food, Beverages, Household / Personal products, Tobacco |

|

| Wide Economic moat - mature industry gone thru phase of consolidation |

| Steady growth though solidly profitable |

|

|

| Often sell at premium valuations. Buy when available at discount |

| Defensive havens during economic down turns |

|

|

|

|

|

|

|

|

|

|

Energy |

|

Major integrated companies, refineries and service companies |

|

| Volatility of commodity prices, with large fixed costs make profits volatile |

| Large fixed costs provide large operating leverage based on commodity prices.

Economies of scale critical |

|

|

| Mature Industry with large cash flows, so good dividends (and share buy backs) |

| Major integrated companies -good long term profitability. Refineries/ Service companies - less profitable and extremely cyclical. |

|

|

|

|

|

|

|

|

|

|

Financial Services |

|

|

|

|

|

|

|

|

|

|

|

- Banks |

|

| High barriers to entry with large capital requirements, regulatory licenses and large economies of scale. |

| Low moat, as a commodity product |

|

|

Given leveraged nature of business - standard metrics include: (i.) Return on Equity, (ii) Return on Assets, (iii) Efficiency ratio |

|

| Valuation metric: Price-to-Book: Given assets liquid and easy to value. |

| challenge more recently been around transperancy and mark-to-market |

|

|

|

|

|

|

- Asset Management |

|

| Asset management companies |

| Custodial services |

|

|

| Wide Economic moat, low capital investment, large economies of scale |

| less so requiring large capital investment and scale (very low margins) |

|

|

High correlation to overall market, with stocks showing large swings. Take a contraian view |

|

|

|

|

|

- Insurance

|

|

Mature, low growth industry with commodity products. |

|

Very competitive. Complex business model. Low economic moat |

|

|

|

|

|

|

|

|

|

|

|

Health care |

|

| highly profitable with strong free cash flow and returns on capital |

| Wide moat (capital intensive, patent protection, economies of scale) |

|

|

| Drug companies, Medical devices: Best |

| HMOs - least attractive |

|

|

Valuations can be steep. Buy when at a discount |

|

|

|

|

|

|

|

|

|

Industrial Materials |

|

Basic Materials/ Chemicals and Equipment/ machinery. |

|

| Low moats - limited pricing power and excess capacity. Poor returns on capital |

| Closely tied to economic cycles - with large swings on both upturn and downturn. |

|

|

Have great companies in a lousy industry (product diversification, economies of scale etc) - but valuations important |

|

|

|

|

|

|

|

|

|

Media |

|

| Publishing, Broadcast, Cable TV and Entertainment Production |

| Competitive advantage within geographic area or niche categories. |

|

|

| Economic moat - where Economies of scale and monopolies exist |

| Subscription based businesses more stable |

|

|

Good investment opportunities, where niche monopolies |

|

|

|

|

|

|

|

|

|

Technology |

|

|

|

|

|

|

|

|

|

|

|

- Software |

|

Database, Enterprise Resource Planning (ERM), Customer Relationship Management (CRM), Security |

|

Wide economic moat - with oligopoly structures, based not on technology but - high switching costs, and network effect |

|

| Cash cows with low capital investments and large growth rates. |

| Considered discretionary spending - subject to economic volatility |

|

|

|

|

|

|

- Hardware |

|

More capital intensive.

Common industry standards |

|

Product cycles, technology changes and price competition changes make economic moats difficult to sustain. |

|

|

|

|

|

|

|

|

|

|

|

Telecom |

|

| Common industry standards |

| Mediocre and declining returns on capital |

|

|

Phone service a commodity. Cut throat competition. No economic moat. |

|

Purchase with large Margin of Safety (MoS)

|

|

|

|

|

|

|

|

|

|

Utilities |

|

De regulation has changed rules of the game, from what was once conservative, high divident stocks |

|

Highly competitive market with volatile commodity prices and high fixed costs |

|

Finacial analysis complex, as must consider impact of regulations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alternate Investments  |

|

Hedge Fund: |

|

| While some funds have excellent track records (and managers) - the best of the best are closed to new investors. |

|

- Most Hedge Funds have high expenses, between 4 - 5%. This is a very high "alpha" on avergage market returns of 7.0%. Clearly some will be get the higher returns, others will not. But the real question is if "your" fund will achieve these higher returns on a consistent basis, over the longer term. The odds are aginst you.

|

|

Venture Capital: |

|

| A wide playing field and if you are not with the best it is not worth playing. The average returns for industry as a whole are lower than returns on Treasury bonds. |

|

- And, similar to Hedge Funds, the best VC funds are closed to new investors.

|

|

Real Estate |

|

| Real estate (separate from mortgage on principal home) does allow for investment benefits including cash flows, tax and leverage. However, it requires significant time and effort. A simpler excample maybe REITS (real estate investment trusts). |

|

- As banks provide loans against real estate, one gets the benefit of leverage. E.g. You can purchase a property worth $ 100,000 with a down payment of $ 10,000 (and $ 90,000 loan). If prices go up 10% (to $ 110,000) you have made a 100% gain on your original investment. However, leverage can work the other way too. A 10% drop in prices (to $ 90,000) can wipe out 100% of your initial investment.

|

|

Commodities |

|

| A critisism of commodities is that they are economically inert i.e. generate no cash flows. Changes in prices are solely based on changes in supply and demand (i.e. speculation). On the other hand, all "fiat" money is based on a promise to pay (and supply and demand). Given the large increase in money supply and government debt, there maybe a case to keep a small percentage of investment in hard currencies or commodities. |

|

|

QUOTES  |

|

|

|

|

Personal Finance |

|

Strategy |

|

|

|

|

|

|

| The poor work for their money. The rich have (their) money work for them |

| Your basic investment goal should be to convert earned income to portfolio or passive income - Robert Kiyosaki |

| Direction of cash flows define assets and liability. An asset puts money in your pocket. A liability takes money from your pocket - Robert Kiyosaki |

|

|

|

|

| Luck is not a success strategy - Charles Farrell, Your Money Ratios. |

| Do not equate simplicity with stupidity - John C Bogle |

| Everything Should Be Made Simple, But Not Simpler - Albert Einstein. |

| Investing is simple - but its not easy - Warren Buffet |

|

|

|

|

|

|

|

Markets |

|

Investing |

|

|

|

|

|

|

| 95% of everything you hear or read (in the financial press/ media) is crap - Burton Malkiel |

It is not a stock market, but a "market of stocks"

- one that lures investors into painful market traps. |

| Old Wall Street question: "What's the fastest way to make a small fortune?". Answer: "Start with a large fortune and try and copy the experts". |

| Understanding the outlook for the next few days or weeks is easy. It will fluctuate - J.P. Morgan. |

Lack of knowledge (of markets) tends to make investors too cautious in bear markets and too confident in bull markets - at considerable cost

- Charles D. Ellis |

| If you check your stock prices more than once a quarter, you are satisfying your curiosity more than your need for information - Charles D. Ellis |

| The two greatest enemies of the equity fund investor are expenses and emotions - John C. Bogle |

|

|

|

|

| The dollars of dividends to be received will be the same per share of stock whether you pay a lot or a little for the shares - Charles D. Ellis |

| If we shopped for stocks the way we shop for socks, we would all be better off - Jason Zweig, Money magazine. |

| In the short run, the market is a voting machine, but in the long run, it is a weighing machine - Benjamin Graham |

| Look down, not up. If you dont loose money, most of the other alternatives look good - Joel Greenblatt |

|

Waren Buffet: |

- Rule #1: Never lose money. Rule #2: Never forget Rule #1

- Understand the difference between price and value.

- Risk is not same as volatility

- Better to buy a great business at a fair price, than a fair business at a great price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL FINANCIAL PLANNING |

|

| The growth of the Financial Services Industry has provided significant benefits to the consumer including ATMs, Money Market Accounts, Mutual Funds etc. However, given the increased complexity of products and information, it is important for families and individuals to have a better understanding and knowledge of the markets and their Personal Finances. |

|

| This is most critical for retirement planning. Today most of us can be expected to live up to 30 years in retirement. Yet companies are increasingly moving away from "defined benefits plan" (guaranteed pension) to "defined contribution plans" - with individuals bearing responsibility for both - investment decisions and risk of running out of money |

|

| As a rule of thumb - financial planners recommend withdrawing no more than 4% - 5% of retirement savings every year. That means a lot of savings even for an average family: |

|

- to get a income of $ 5,000 per month - will require a retirement nest of $ one and a half million! Even assuming $ 1,500 from social security etc. - a monthly income of $ 3,500 in retirement would mean savings of just over 1 million.

- 80% pre retirement income during retirement will require approx 16x - 18x annual salary in savings.

|

|

| How does one save enough over 30 years of working life for 30 years in retirement? The answer is simple - the magic of Compound Interest |

|

- Simulations show that - starting early, saving regularly and getting a steady rate of return - will mean your required retirement nest will consist approx. 30% of your savings and 70% from cumulative interest.

|

|

| Importantly - Savings is different from Investing. A few percentage points in interest rates can mean a huge difference in your future wealth. Therefore, while stocks may be a riskier investment in the short run, in the long run the rewards can certainly outweigh the risks. But, again "speculation" is different from Investing. Do Not speculate |

|

- If you saved $ 100 per month for 40 yrears. At 3% interest you would have approx. $ 92,000 (2x savings); At 5% - $ 152,000 (3x savings) , And @ 9% - over 465,000 (10x your savings)

- Conversely ofcourse - Inflation is yoır # 1 Risk in retirement. As an example to maintain a lifestyle of $ 60,000 per year at 3% inflation (historical average) - you will need $80,000 a year in 10 years; $120,000 a year in 20 years (age 85, if you retire at 65). Along with safety, one needs to ensure a good return on investments - even after retirement.

|

|

| Savings and Investments - are amongst the most important and long lasting decisions - one may make today. And while the sheer volume and complexity of information and products can be over whelming - it need not be complex. And there is no need to reinvent the wheel here. There are enough good books and tools in the market. The aim of this web site is to list my personal favourites: |

|

| But, some basic guidelines:

(i.) start investing early,

(ii.) invest as much as possible, and

(iii.) attempt to earn a reasonable rate of return. |

|

| 1. Investments: |

|

- Pay yourself 1st: Set up regular monthly plans. This ensures discipline as well as allows benefit of dollar cost averaging.

- Asset allocation: Over a longer period asset allocation has shown to be the most important factor in determining returns from investing (with stock selection and market timing, having only secondary roles). The mix should be determined by both - (i.) Individual objective(s) - growth, income, safety, and (ii.) timing, when money will be required (Equities are best suited for long term investments)

- Keep it Simple: Diversified and low cost index funds (or ETFs) – have the advantages of - (i.) diversification , and (ii.) lower costs. Focus on Fees (in the Investment world - you get what you do,nt pay for!).

|

|

| 2. Stocks: |

|

- If you do want to invest in stocks - one needs to educate oneself and be prepared to spend time. But some simple rules In stocks you are purchasing future cash flows. Price at which you buy is as important as what you buy. Analyze companies "economic moat" and earnings. Ensure the price allows a margin of error.

|

|

| 3. Debt: Pay down your Debt. |

|

- Mortgage: Not an investment but a home. Try and pay back early in a prudent manner

|

|